A Strategic Playbook for Winning Beauty Commerce in 2025

The beauty counter has moved from the department store to the palm of your hand. According to AUC’s 2024 Social Commerce Beauty Study – which surveyed more than 5,000 U.S. consumers – 58% of social media shoppers are now purchasing beauty products directly on their favorite platforms, making beauty the second-most purchased category in social commerce. This isn’t just a trend—it’s an unprecedented transformation of how consumers discover, evaluate and purchase beauty products in a fundamental way.

As social commerce races toward sales projected to grow 22% and reach over $101B in 2025 (eMarketer, 2024), beauty brands face a critical inflection point. Those who master this new digital beauty counter will thrive; those who don’t risk losing connections with an increasingly social-first consumer base. At Advantage Unified Commerce (AUC), we’ve identified the key strategies to separate winners from observers in this rapidly evolving landscape.

The Rise of Social Commerce

Platforms like TikTok, Instagram and Facebook have revolutionized how beauty shoppers discover and purchase products. The impact of this transformation was evident during the 2024 holiday season when, according to Retail Dive, TikTok Shop’s Black Friday sales exceeded $100MM—with beauty emerging as a standout category.

Our 2024 Social Commerce Beauty Study reveals Instagram as the leading platform for beauty purchases, with 71% of social beauty shoppers making purchases through the platform, showcasing its dominance in influencing beauty commerce.

According to AUC’s 2024 Social Commerce Beauty Study (n=480):

Social Media Platforms Most Used by Social Beauty Shoppers

- Facebook (91%)

- Instagram (90%)

- TikTok (78%)

- X (formerly Twitter) (53%)

- Pinterest (46%)

- Snapchat (41%)

Social Media Platforms Used to Buy Beauty Products

- Instagram (71%)

- Facebook (59%)

- TikTok (53%)

- Pinterest (24%)

- X (formerly Twitter) (21%)

- Snapchat (17%)

Strategic Focus

- Platform-specific Insights: Understanding unique platform behaviors is crucial. For example, TikTok excels at discovery, while Instagram drives inspiration and conversion.

- Actionable Tip: Create platform-specific content that mirrors the native user experience to boost engagement and sales.

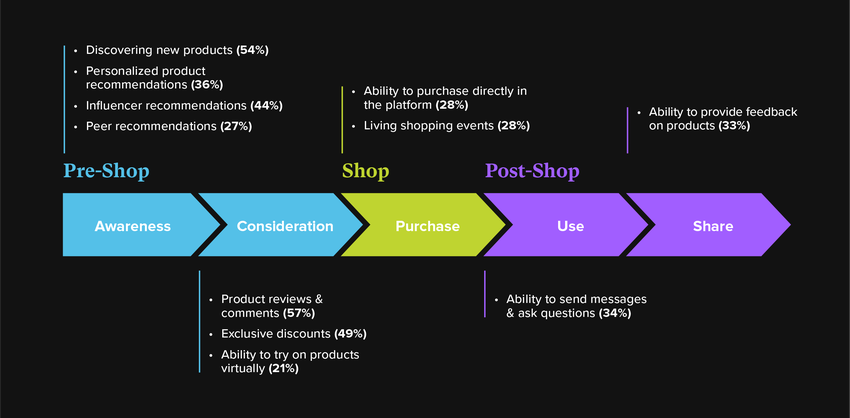

The Collapsed Shopper Journey

Social commerce has streamlined the customer journey, allowing shoppers to discover, evaluate and purchase products in seconds. AUC’s 2024 Social Commerce Beauty Study highlights this shift, revealing that more than half of social beauty shoppers (54%) enjoy discovering new beauty products on social media, while 28% appreciate the ability to check out directly within social platforms.

According to eMarketer’s latest research, platforms like TikTok are accelerating the path to purchase by enabling content creators to embed product links from third-party retailers directly in posts, creating new opportunities for beauty brands and retailers to partner on social commerce programs.

What Social Beauty Shoppers Value Most

- Discovery: Engaging visual content from influencers and brands

- Evaluation: Social proof through reviews, comments and live demonstrations

- Purchase: Seamless, in-platform checkout options

AUC’s 2024 Social Commerce Beauty Study Reveals Key Preferences

What Social Beauty Shoppers like about shopping for beauty products on social media

Strategic Focus

- Optimize the Journey: Layering purchase paths ensures accessibility and personalization across diverse shopper segments. Each touchpoint—from inspiration to purchase—should be seamless.

- Actionable Tip: Invest in content formats like live shopping events and shoppable posts to cater to multiple stages of the journey.

Beauty Content that Converts

According to AUC’s 2024 Social Commerce Beauty Study, beauty shoppers are heavily influenced to purchase beauty products on social media through authentic connections and visual storytelling—ranking these factors ahead of exclusive offers and discounts (37%) and expert endorsements (19%).

The power of social proof emerges as a dominant force in purchase decisions, with our research showing 67% of beauty shoppers rely on reviews to make their choices. User comments (48%) provide an additional layer of credibility, while influencer recommendations (44%) help validate product efficacy and demonstrate real-world results.

Engaging visual content proves equally crucial in driving conversion. Our study reveals that high-quality product images influence 51% of beauty purchases on social platforms, while dynamic videos impact 46% of buying decisions. Product demonstrations, which bridge the gap between online shopping and in-store experiences, influence 41% of social beauty purchases.

Strategic Focus

- Create to Convert: Leverage short-form videos, interactive tutorials and user-generated content to build trust and drive sales

- Actionable Tip: Incorporate strategic influencer partnerships to amplify authenticity and reach.

#TrendingIn2025

AUC’s 2024 Social Commerce Beauty Study reveals that social beauty shoppers are looking forward to making proactive, informed and mindful decisions going into 2025 to set up themselves, their skin and the planet for the best possible results.

Our comprehensive research identifies clear priorities among social beauty shoppers for 2025, with clean beauty at the top of their list with 56% of respondents expressing strong interest. Sustainability emerges as a key driver, with 47% of shoppers prioritizing eco-conscious products. The study also highlights a significant focus on preventative skincare (44%), while both beauty tech innovations and ingredient transparency tie at 39%, showing the dual consumer interest in both advancement and authenticity.

Trends beauty social commerce shoppers are most excited about in 2025:

- Clean Beauty (56%)

- Sustainable Products (47%)

- Preventative Skincare (44%)

- Ingredient Transparency (39%)

- Beauty Tech Innovations (39%)

Strategic Focus

- Transparency & Trust: Social beauty shoppers demand ethical, sustainable and effective beauty solutions.

- Actionable Tip: Highlight credentials, ingredient sourcing and sustainability initiatives in your 2025 social commerce content.

The Social Commerce Imperative

The convergence of social media and commerce has fundamentally transformed beauty retail. With 70% of the U.S. population (239 million people) actively using social platforms (DataReportal, 2024), these channels are now essential for brand growth. Social platforms deliver unprecedented advantages through captive audiences, personalized recommendations and authentic two-way engagement. The transparent ecosystem of reviews and realtime feedback enables confident and informed beauty purchasing decisions.

Your Partner in Social Commerce

AUC delivers comprehensive solutions across the social commerce ecosystem. We help brands optimize their presence through platform-specific campaigns, seamless shopping experiences and content strategies that drive measurable results. Through strategic planning and proven execution, we enable beauty brands to capitalize on emerging opportunities—from livestream shopping to AI-powered personalization. Most importantly, we understand how to translate beauty’s core values and trends into compelling and effective social commerce experiences that resonate with today’s digital-first consumer.

For complete findings from our 2024 Social Commerce Beauty Study, including platform analytics, demographic insights and trend forecasts, contact our team to discuss strengthening your brand’s digital presence in 2025.

Sources

- AUC Social Commerce Survey, 12/12/24, N-5001, Beauty social shoppers, N=1541

- EMARKETER: 5 charts on the holiday social commerce opportunity, 10/7/24

- Retail Dive: TikTok Shop sales surpass $100M on Black Friday, 12/11/24

- AUC Social Commerce Survey: Q2: Which of the following social platforms do you regularly use? 12/13/24, N-428

- AUC Social Commerce Survey: Q3: Which social media platforms have you used to make a beauty purchase? 12/13/24, N-423

- AUC Social Commerce Survey: Q4: What do you like about shopping for beauty products on social media? 12/13/24, N-380

- AUC Social Commerce Survey: Q5: What factors influence your decision to purchase beauty products on social media? 12/13/24, N-379

- AUC Social Commerce Survey: Q6: What beauty trends are you most excited about in 2025? 12/13/24, N-378